New road tax rules explained: here's what you'll pay

From 1 April 2017, your VED rates will change quite dramatically. Here's how

Road tax is changing, and the formula is getting more complex. From 1 April 2017, there's a new system for vehicle excise duty. That's what we used to call the tax disc - but there's no paper disc any longer.

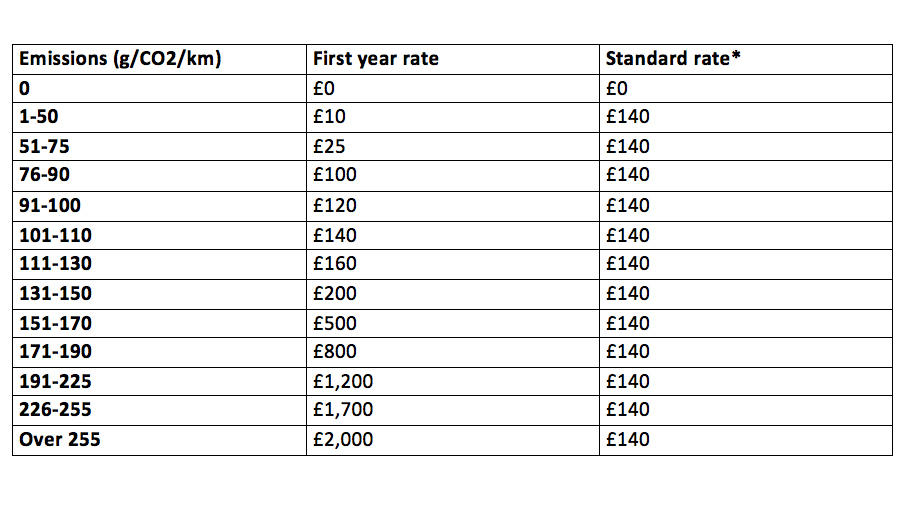

The system is made up of three elements. In the first year, the duty is a sliding scale, based on homologated emissions. It runs from zero for zero-emissions cars to (gulp) £2,000 for anything over 255g/km.

But every year after that, there's no emissions element. It's a flat fee, called 'standard rate', of £140. (Well, there's almost no emissions element: zero-emissions cars are £0, but even 1g/km pulls you into the £140 territory).

The third element is that from years two to six, any car costing more than £40,000 when registered is hit with a £310 supplement.

The figures look like this:

*cars over £40,000 pay £310 supplement for 5 years

So, buy a thirsty car and you pay dearly in the first year – up to £2,000. Buy an expensive one and you pay in subsequent years – £450 a year for anything that isn't a pure zero-emission car.

At first sight it's a bewildering system, with widely differing penalties and incentives between the first year and later years.

The first year penalises high-emitting cars with a graduated tax, while the later years penalise purchase price, but only with a single blunt step.

Top Gear

Newsletter

Thank you for subscribing to our newsletter. Look out for your regular round-up of news, reviews and offers in your inbox.

Get all the latest news, reviews and exclusives, direct to your inbox.

According to HMRC, the new duty has been designed because too many cars in the old system were paying very little duty. In other words the previous CO2-based regime (as well as CO2-based company-car taxes and indeed fuel taxes which also favour economical cars) had been too successful. People were driving low-CO2 cars and so revenue was falling.

Also, in the old system, people driving old cars, which tend to be thirstier, pay more in VED than people who can afford newer thriftier ones. This, said HMRC, was a "significant unfairness".

So the new system is designed to increase revenue – that is, tax us more – and show a renewed incentive for low-CO2 cars. Why is VED different in later years than the first? Says HMRC: "The first-year rates incentivise uptake of the very cleanest cars, whilst moving to a flat SR makes the tax fairer and simpler."

By the way, cars bought before April will still use the old system, and that isn't scheduled to ever change.

Maybe some examples would help. A 91-100g/km car pays £120 in the first year and £140 in years two to six. Currently those cars would be £0 in year one and £20 afterward. A significant hike then. That applies to a Citroen C1 or a Jaguar XE diesel 165bhp Portfolio, which is a £34k car.

And it only takes the slightest tickle of the Jag's configurator to nudge it beyond a with-options £40,000. That lands it with £450 for years two to six, up from £20 a year for an identical car registered this month.

At the other end of the price/emissions scale, a Mustang V8 Manual with few options squeezes under £40k so avoids the later-years penalty and sits pretty at £140 a year. But it easily careers into the £2,000 first-year hit.

Still, the Mustang is an outlier. You have to look a long time indeed (possibly for ever, unless you know different, commenters) to find other cars in that price bracket that hit the big two-five-five on CO2. Even a V6 Jeep Cherokee is far too economical.

But most cars won't change much. Vauxhall sent out a statement urging people to buy before April to save tax. It gave the example of a Mokka diesel FWD where, over a four-year ownership, the average rise is just £15 a year. Hardly a significant hurdle against other costs of buying and running a car.

Still, across the whole nation's cars, it all adds up. HMRC estimates that after 2020, when older cars paying the current system will be going out of use, the new VED will be worth an extra £1.4bn a year. Only a fraction of what's needed to bandage the NHS deficit, mind.

Very few cars actually get to 255g/km these days. Even a BMW M3 is 204g/km. Which sits it in the £1,200 first-year VED bracket. If you bought the M3 with cash, you'd pay £9,500 in VAT alone. Of course most people buy on lease or PCP, which spreads the VAT over the term of ownership, and they've a trade-in. But you see the point. VED isn't the most significant of motoring taxes.

Then there's company car tax. Thousands a year for many.

And fuel. Did you know that two-thirds of the price of a litre is duty and tax? So if you do 35mpg (and you won't, not in an M3) over 10,000 miles a year, that's more than £1,500 a year in fuel, of which £1,000 goes to HMRC.

There's going to be a furore over this VED increase. As there was, fatally, over the self-employed national insurance increase. I wonder why the Government didn't just abolish VED – cue big political hurrah – and roll a compensating increase quietly into fuel prices. The policy aim would be satisfied. Fuel use is directly proportional to real CO2 (not to basically fake homologated CO2 numbers). And the complexity would go away.

Paying less fuel tax is simple. I said simple, not easy. Drive less; drive more economically; and choose a more economical car.

Trending this week

- Car Review

BMW 1 Series

- Top Gear's Top 9

Nine dreadful bits of 'homeware' made by carmakers